will salt deduction be eliminated

And a provision that reduced the total value of certain itemized deductions by 3 percent of the amount by which a taxpayers AGI exceeded a specified. Roughly 330000 people in the 17th Congressional District or 45 percent use the SALT deduction.

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

The state and local tax SALT deduction cap will be eliminated for five years as part of the Build Back Better social spending package according to multiple reports.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

. The state and local tax SALT deduction cap will be eliminated for five years as part of the Build Back Better social spending package according to multiple reports. House Democrats passed a coronavirus relief bill in May that would repeal the SALT deduction cap for two years but that bill is not expected to be considered in the Republican-controlled Senate. Enacted by the Tax.

However its been a controversial. Nov 2 2021. According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back Better reconciliation package including one retroactive year.

Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married.

Additionally several itemized deductions such as the deductions for unreimbursed employee expenses and tax preparation fees that were temporarily eliminated by the 2017 act will be reinstated. No Eliminating The Salt Cap Will Not Reduce Charitable Giving The State And Local Tax Deduction Explained Vox How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less How Does The Deduction. The topic goes beyond simple politics.

Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers. Defenders of the SALT deduction such as the National Governors Association point out that state and local income real estate and sales taxes are mandatory. First instituted our federal income tax.

Why the SALT Deduction Matters. The tax deduction applies to both primary and secondary residences. The liberal Brookings Institution think tank called the SALT deduction a handout to the rich and urged that it be eliminated entirely.

The cap would be suspended for all taxpayers from 2021 to 2025 under the latest proposal according to a Ways and Means Committee aide. Trumps tax law limited SALT deductions to 10000 meaning that residents in higher-tax states like New York and New Jersey could no longer deduct the full value of. It should be eliminated not expanded.

According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back Better reconciliation package including. The 10000 cap would then be reinstated from 2026 to 2030. New limits for SALT tax write off.

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. The deduction for state and local taxes has been around since 1913 when the US. The MID is an income tax deduction that can be taken on interest paid on up to 750000 of mortgage debt for married couples 375000 for single filers.

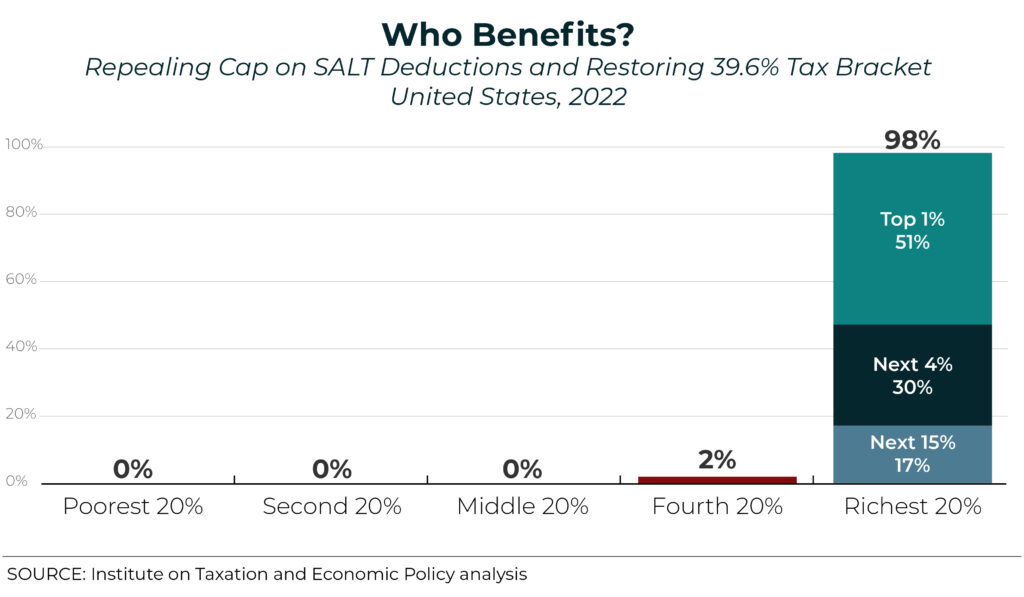

So if you and your spouse owe 500000 in mortgage debt on your townhouse in Seattle and 250000 in mortgage debt on your. It is important to understand who benefits from the SALT deduction as it currently exists and who would benefit from the deduction if the cap were repealed. Many economists believe that a complete repeal of the cap on the SALT deduction would be costly to the federal government.

The new SALT deduction will apply retroactively to income taxed between 2021-2025 and the 10000 cap will be reinstated from 2026-2031. The average property tax bill in the district is 11389 according to a. Yes eliminating the SALT deduction will be a tax primarily on the wealthy minority sorely needed to pay for programs to rebuild the country.

A recent July 2021 estimate by the Tax Foundation put the loss to the Federal government at 380 billion. 54 rows Some lawmakers have expressed interest in repealing the SALT cap which was originally imposed as part of the Tax Cuts and Jobs Act TCJA in late 2017. This significantly increases the boundary that put a cap on the SALT deduction at 10000 with the Tax Cuts and Jobs Act of 2017.

The SALT tax deduction is a handout to the rich. By this logic we should get rid of all tax deductions since most lower and middle income households dont itemize their deductions. Taxpayers cant get out of them.

Though there is a controversy behind this change as the average SALT tax paid isnt even one-tenth. The SALT deduction should be eliminated altogether along with the wide range of energy tax credits housing credits and place-based credits such as opportunity zones. Capping or eliminating SALT punishes people for living in areas that want or need to raise money to provide public services and double-taxing income strikes me as generally unfair in principle.

The federal tax reform law passed on Dec.

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

State And Local Tax Salt Deduction Salt Deduction Taxedu

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

The Salt Cap Overview And Analysis Everycrsreport Com

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Opinion The Debate Over A Tax Deduction The New York Times

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget